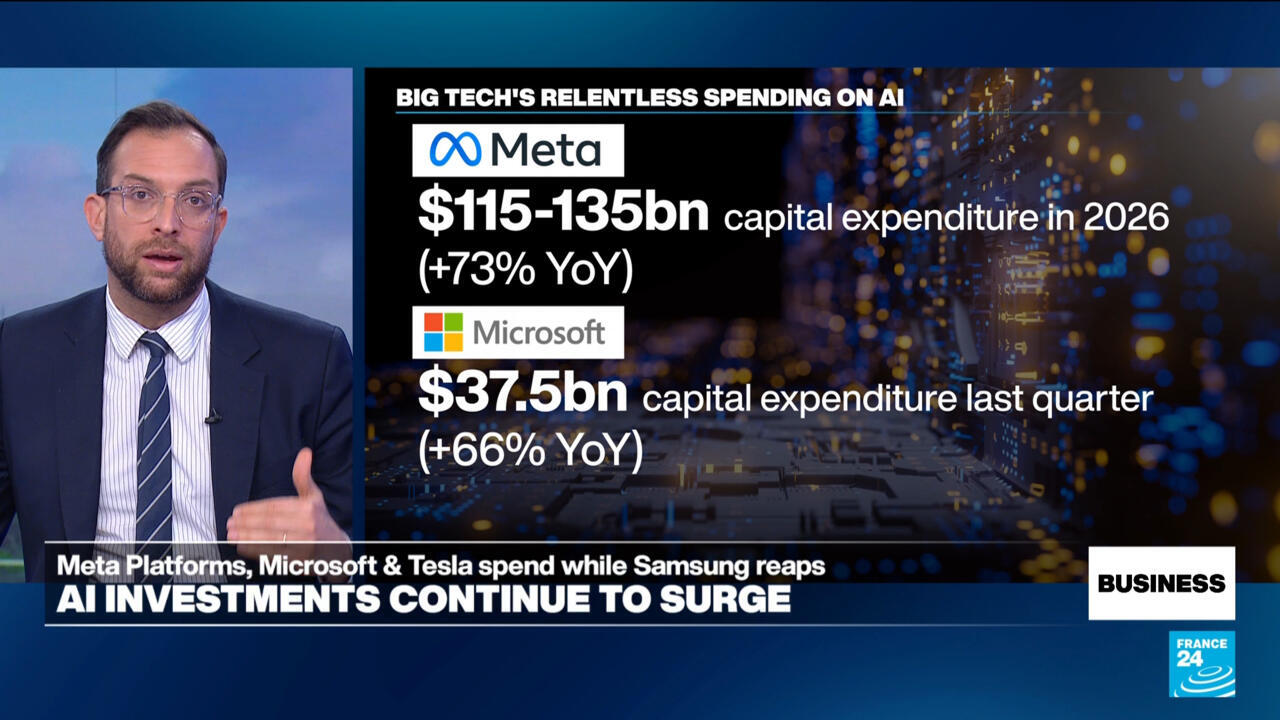

The latest round of corporate earnings from major technology bellwethers, specifically Meta Platforms and Microsoft, underscores a fundamental and accelerating trend in the global technology sector: the insatiable demand for capital allocation toward Artificial Intelligence capabilities. Both firms signaled intentions for sustained, high-level spending, effectively validating AI as the central competitive arena for the immediate future.

This robust commitment to AI infrastructure investment comes as the broader technology landscape experiences significant divergence. While software and cloud giants continue to pour resources into generative models and supporting data centers, the automotive sector is exhibiting structural shifts.

Tesla, historically synonymous with electric vehicle (EV) manufacturing, posted its first-ever annual revenue decline. Crucially, the company announced a strategic reorientation, signaling a decisive pivot away from prioritizing pure EV volume toward focusing intently on AI and advanced robotics applications. This move suggests a recognition that future valuation premiums may reside more in intelligent systems than in vehicle production metrics alone.

Meanwhile, the foundational layer of the AI boom remains highly lucrative for hardware enablers. Companies such as Samsung Electronics are directly benefiting from the surge in demand for specialized components necessary to power these vast AI operations, positioning them as critical choke points in the supply chain.

From an economic perspective, this dual narrative—hyper-spending in pure AI versus strategic reassessment in adjacent hardware sectors—highlights the bifurcation of investment risk and reward. The market is currently rewarding entities that control the AI stack, whether through foundational models or the necessary semiconductor backbone.

Geopolitically, these expenditure patterns solidify the technological leadership aspirations of the United States-based giants, while simultaneously increasing dependency on the complex, globalized supply chains required to realize these ambitions.

These financial disclosures serve as a critical benchmark, setting expectations for sector-wide CapEx throughout the coming fiscal year. Investors are now keenly watching for the tangible return on these multi-billion-dollar AI bets, moving the focus from investment volume to demonstrated profitability metrics.

This analysis is based on quarterly financial disclosures reported on Wednesday, as detailed by sources including France 24.