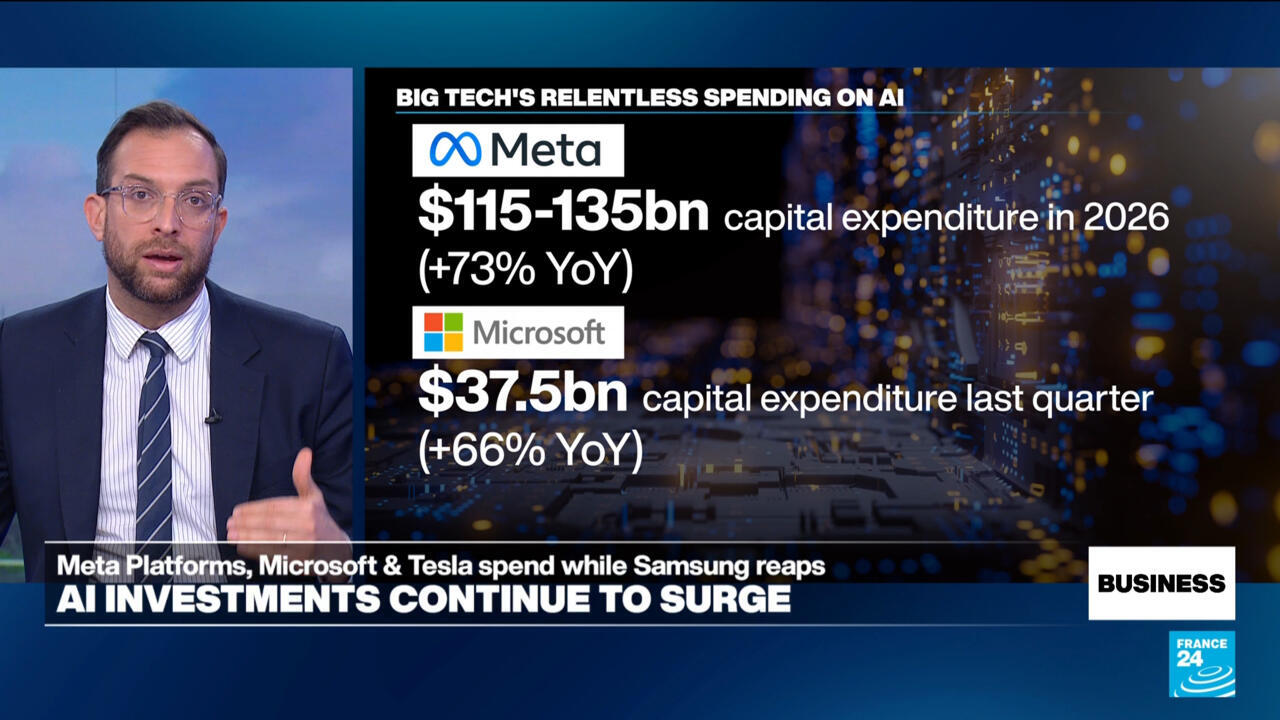

Meta Platforms and Microsoft released their latest quarterly financial results on Wednesday, both demonstrating an unwavering commitment to significant, ongoing investment in artificial intelligence capabilities. These expenditures reflect the ongoing technological arms race among major technology firms seeking dominance in AI development and deployment.

This aggressive spending, according to analysis of the reports, raises implicit questions regarding the near-term profitability timelines for these enormous infrastructure outlays. While revenue growth remains robust for many, the capital intensity required for advanced model training and data center expansion places pressure on margins.

Further complicating the technology sector's narrative, Tesla reported a decline in its annual revenue for the first time in its operational history. The electric vehicle manufacturer simultaneously announced a strategic realignment, prioritizing investments in artificial intelligence and advanced robotics over traditional automotive sales.

Hardware component manufacturers are currently benefiting directly from this digital transformation wave, according to industry observers. Companies like Samsung Electronics are actively enabling the AI expansion by supplying necessary high-performance semiconductors and related infrastructure, thereby capturing significant near-term revenue from the boom.

These dual corporate signals—heavy investment by software giants and strategic redirection by automotive leaders—paint a composite picture of the current economic focus. The global technology sector is clearly prioritizing foundational AI capability acquisition over short-term capital efficiency measures.

The market response to these disclosures will be critical in determining investor sentiment toward future AI-driven growth versus immediate fiscal responsibility. Analysts will scrutinize forward-looking guidance for metrics indicating the path toward monetizing these substantial AI investments.