The European Union has formally moved to designate Iran’s Islamic Revolutionary Guard Corps (IRGC) as a terrorist organization, marking one of the most severe escalations in the bloc's sanctions architecture against Tehran to date. This decision, confirmed by high-level EU foreign policy officials, redefines the IRGC's status within European legal frameworks, moving beyond existing sanctions on individuals and entities associated with the force.

This designation is not merely symbolic; it imposes far-reaching financial and operational restrictions. EU institutions and member state entities will now be legally obligated to sever ties with any element of the IRGC, including freezing assets and prohibiting any form of financial or material support. The practical implications for European businesses operating in or near the Middle East will require immediate reassessment of compliance protocols.

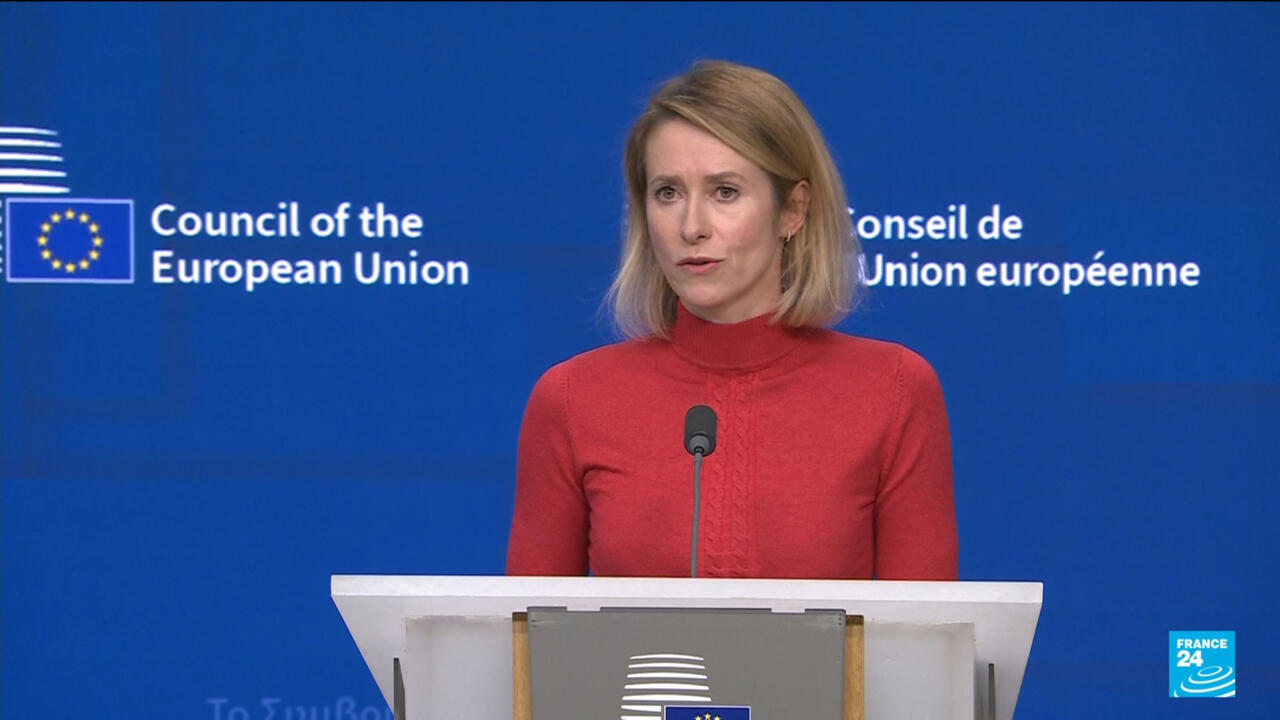

Sources within Brussels indicate that the decision follows sustained internal pressure, particularly from member states citing the IRGC’s alleged involvement in international destabilization efforts and domestic repression within Iran. The move represents a significant political alignment with Washington’s hardline stance, although the EU has historically sought a more nuanced diplomatic path.

Geopolitically, this development is expected to harden Tehran’s posture. Iranian officials have consistently warned that such designations constitute an act of aggression and will inevitably lead to reciprocal measures targeting European interests. The immediate focus will be on how Tehran chooses to respond to this direct challenge to its core security apparatus.

Furthermore, the move complicates ongoing, albeit limited, diplomatic channels concerning regional security and nuclear non-proliferation efforts. While the EU maintains its commitment to dialogue, formalizing the IRGC as a terrorist body inherently raises the threshold for future high-level engagement.

Economic analysts are closely monitoring market reactions, particularly concerning energy supplies and regional trade flows. The increased sanctions risk profile could deter European investment in areas where the IRGC holds significant economic sway, potentially creating new vulnerabilities in global supply chains.

This represents a definitive 'diplomatic shift' for the EU, prioritizing security and human rights concerns over the maintenance of a status quo relationship with the Islamic Republic. The implementation and enforcement mechanisms across all 27 member states will be crucial in determining the efficacy and ultimate impact of this powerful regulatory tool. (Source: Based on reporting citing EU foreign policy briefings and official statements.)